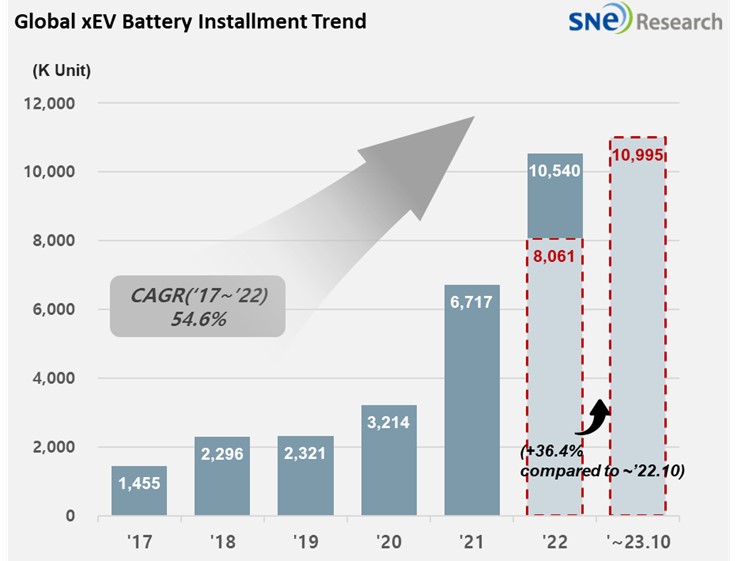

From Jan to Oct in 2023, Global[1] Electric Vehicle Deliveries[2] Posted 10.995 Mil Units, a 36.4% YoY growth

- BYD ranked 1st, Tesla 2nd, and Hyundai-KIA 7th in the Global EV Market

From

Jan to September 2023, the total number of electric vehicles registered in

countries around the world was approximately 10.995 units, a 36.4% YoY

increase.

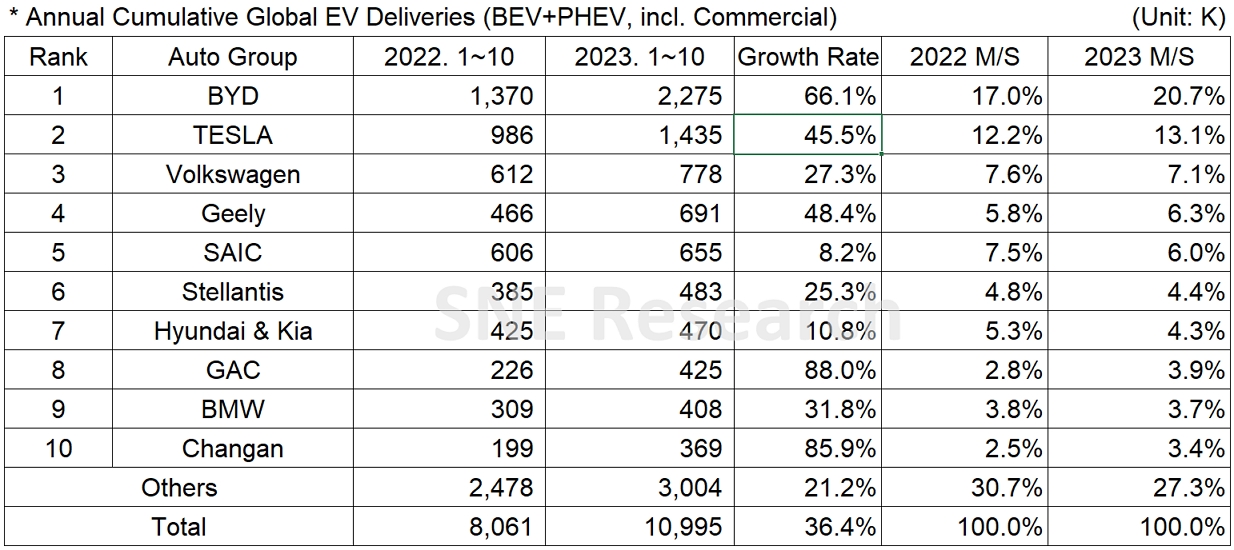

In

the global EV sales by major OEMs from Jan to October in 2023, BYD, a leading

EV company in China posted a 66.1% YoY growth and kept the top position in the

global ranking. BYD accounted for the largest pie based on its variety of

line-up including Song, Yuan Plus (Atto3), Dolphin, and Qin. In addition, BYD

boasted 10 times higher growth compared to last year, exporting almost 80k

units in other regions than China. Tesla, delivering more than 1.43 million

units to customers, recorded a 45.5% YoY growth. Tesla main models – Model 3

and Y – enjoyed favorable sales. With the scheduled launch of Model 3 facelift

Highland and Cybertruck, attentions should be paid to how these new models

would influence the future sales performance of Tesla. The Volkswagen Group,

ranked 3rd on the list, posted a 27.3% growth by delivering approx.

780k units to customers mainly with ID.3/4, Audi Q4, and Q8 E-Tron.

(Source:

Global EV and Battery Monthly Tracker – Nov 2023, SNE Research)

Hyundai-KIA

Group recorded a 10.8% YoY growth by selling more than 470k units of IONIQ 5/6,

EV6, Niro, and Kona. The Group, who broke the record of the highest performance

in Q3 this year, announced that it would focus on expanding its market share by

promoting the global awareness of IONIQ and by increasing the sales of

eco-friendly vehicles through strengthening the line-up of hybrid models.

(Source: Global EV and Battery Monthly

Tracker – Nov 2023, SNE Research)

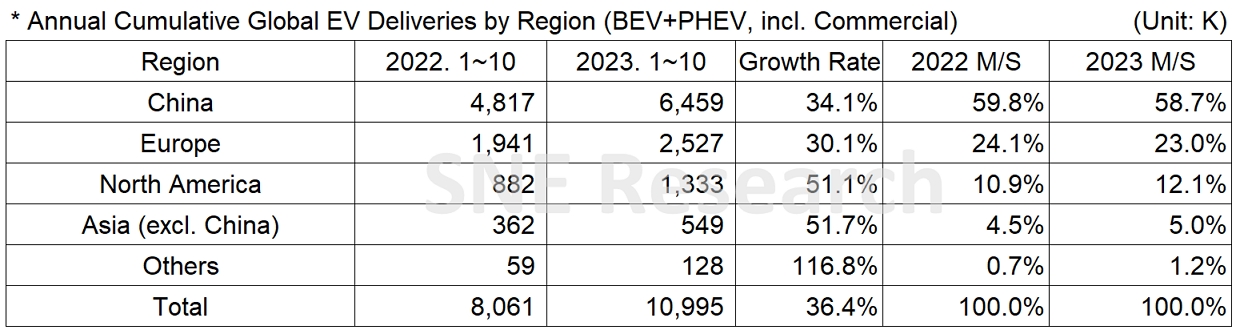

By

region, China boasted an unequaled position by taking up 85.7% of market share.

China’s current growth momentum is mainly led by BYD who both supplies batteries

to its vehicles and manufactures electric vehicles. BYD, who secured price

competitiveness through vertical integration and focused on new-energy cars, have

sold approx. 2.275 million units in China this year. Given the entire sales of

new-energy cars in China this year being 6.459 million units, it can be said

that among 3 new-energy cars sold in China, one should be made by BYD. In last

July and October, BYD even outperformed Tesla in terms of monthly sales of pure

electric vehicles except PHEV.

On December

1, the US Treasury Department and Energy Department released proposed guidance clarifying

the definition of ‘Foreign Entity of Concern (FEoC).’ To be eligible for the subsidy

program under the IRA, EV makers and battery companies should address new challenges

such as gradually modifying the proportion of FEoC by 2026, manufacturing car

parts, extracting/processing critical minerals, and establishing tracking

systems. While the global EV makers, including Hyundai-KIA, increasingly

adopted LFP battery these days, some analysts suggested that the US IRA and its

specific regulations may act as a great opportunity for the K-trio who have

been accelerating the development and production of LF(M)P.

Amidst

uncertainties such as economic downturns, fluctuations in price of energy and

minerals, and changes in eco-friendly policies and regulations, the EV market

overall has shown a steady growth. As more customers are expected to continue

focusing on cost-effectiveness and price of electric vehicles, it is expected

that customer demand would center around low- and middle-priced electric

vehicles, continuously fueling the growth of EV market.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.